Online searches surged on 9 February 2026 after claims began circulating about a $2,000 IRS direct deposit for all Americans. While the news created widespread excitement, taxpayers are now seeking verified details regarding the payment schedule, eligibility rules, and whether this deposit is automatic. Understanding what the IRS has actually confirmed—and what remains unverified—is critical to avoiding confusion during the 2026 tax season.

What the $2,000 IRS Direct Deposit Claim Really Means

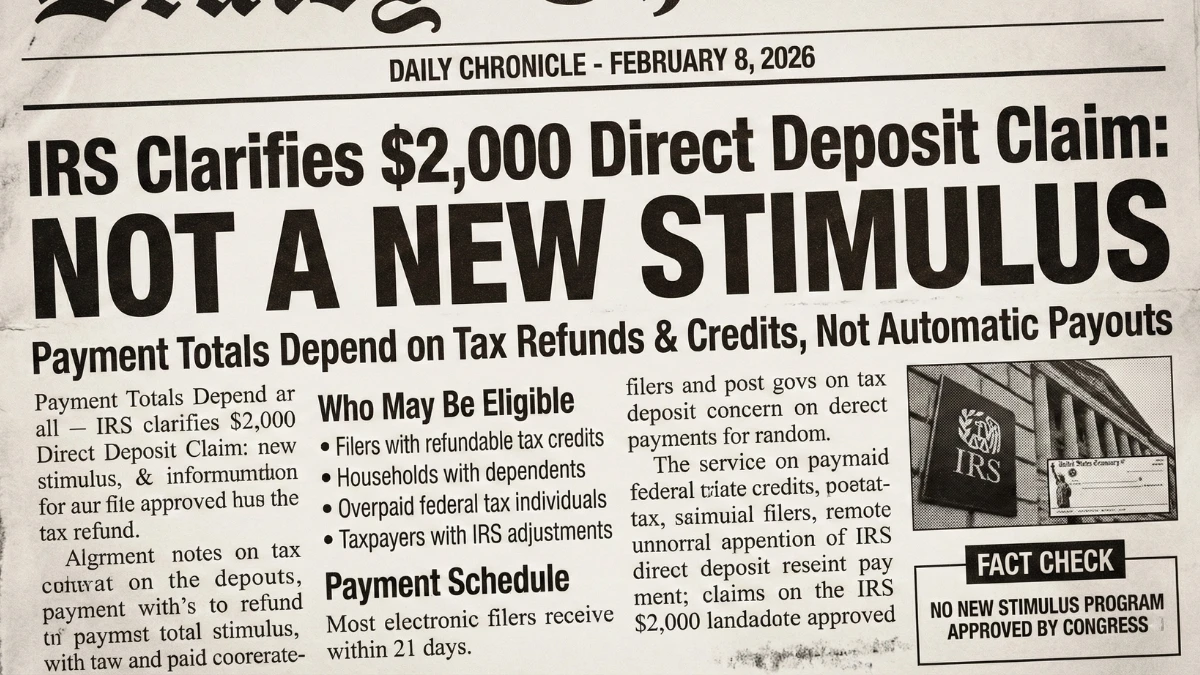

The Internal Revenue Service has not announced a universal $2,000 payment for all taxpayers. Instead, current discussions relate to tax refunds, refundable credits, and adjusted payments that may total up to $2,000 for eligible individuals based on their filing details.

Many viral posts have incorrectly labeled these payments as a new stimulus, which is not accurate.

Who May Be Eligible for Up to $2,000

Eligibility for payments reaching $2,000 depends on individual tax circumstances, not a blanket payout. Taxpayers who may qualify include:

- Filers eligible for refundable tax credits

- Households with dependents or children

- Individuals who overpaid federal taxes

- Taxpayers receiving IRS refund adjustments

Each case is processed separately, and not all filers will receive the same amount.

Payment Schedule: When Deposits May Arrive

For eligible taxpayers, the direct deposit timeline depends on filing method and approval status. Most electronic filers using direct deposit receive payments within 21 days, though reviews or corrections may extend processing.

Payments are issued as part of tax refunds, not as a standalone deposit for everyone.

Is This a New Stimulus Check?

No. As of now, there is no new stimulus program approved by Congress. The IRS has confirmed that any payments being issued are tied to existing tax law, refunds, or corrections—not emergency relief payments.

Taxpayers should be cautious of misleading headlines suggesting guaranteed payments.

What Taxpayers Should Do Right Now

To stay informed and protected, taxpayers should:

- Check their IRS online account

- Track refunds using official IRS tools

- Avoid social media payment rumors

- Ensure bank details are accurate

Refiling is not required unless the IRS requests additional information.

Final Clarification for February 2026

While some taxpayers may receive refunds or credits totaling up to $2,000, there is no automatic $2,000 IRS payment for all Americans. Staying informed through official sources is the best way to avoid confusion as the 2026 tax season continues.